Navigating the Aftermath of a Crash: Your Medical Bill Guide

Accidents happen in the blink of an eye, and when they do, the aftermath often includes overwhelming medical bills. If you’ve been in a car crash, knowing how to handle these expenses is critical. From understanding what your insurance covers to dealing with hospitals and debt collectors, every step matters. Speaking with a personal injury lawyer early can help you navigate the complex process of paying medical bills and ensure you receive fair compensation.

Understanding Medical Bills After a Crash

Medical bills after a crash can include ambulance rides, emergency room visits, hospital stays, surgery, prescription drugs, physical therapy, and follow-up care. These costs add up quickly, and you may be responsible for the full amount if insurance coverage is unclear.

Common Types of Medical Expenses

- Emergency room and trauma care

- Imaging services like X-rays or MRIs

- Prescription drugs and medical equipment

- Hospital stays and outpatient visits

- Ongoing treatments and specialist visits

Who Pays Medical Bills After a Crash?

Responsibility for paying medical bills depends on your insurance, the other driver’s insurance, and whether you have government health insurance programs like Medicaid or Medicare. Initially, you may need to pay or arrange payment even if you’re not at fault.

Your Options Might Include:

- Personal health insurance

- Medical payment coverage (MedPay) on your auto policy

- The other driver’s insurance company (after claim approval)

- Out-of-pocket payments or medical credit cards

Using Health Insurance to Cover Crash-Related Medical Bills

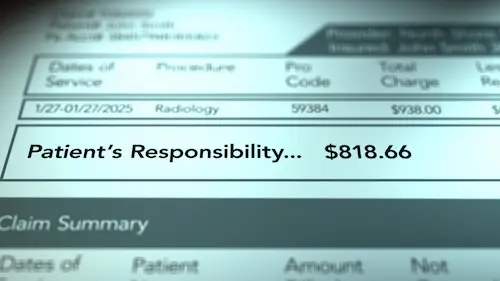

Health insurance is typically your first line of defense against rising medical expenses. It may not cover everything, but it helps reduce the total amount owed. Keep every explanation of benefits (EOB) document you receive, as they detail what is covered, what the insurance company paid, and what you still owe.

Key Tips:

- File claims promptly

- Stay in-network for lower costs

- Ask your provider to bill your insurance first

What Happens If You Can’t Pay Medical Bills?

Many crash victims worry about medical debt and how it affects their finances. When bills go unpaid, hospitals may send them to debt collectors or report them to consumer reporting agencies, impacting your credit scores.

Negative Outcomes:

- Damage to credit reports and lower credit scores

- Aggressive debt collection practices

- Legal action for unpaid bills

Programs and Resources to Help With Medical Debt

If you are struggling with medical bills, you are not alone. There are resources available for patients, especially low income patients or those without health insurance.

Available Assistance:

- Charity care: Offered by nonprofit hospitals

- Financial assistance: Hospitals may reduce or forgive bills based on income

- Government programs: Medicaid, Medicare, and ACA subsidies can help

- National Consumer Law Center: Offers guidance on medical debt relief

Dealing With Surprise Medical Bills

Surprise medical bills arise when you unknowingly receive treatment from a provider outside your insurance network. These can be avoided under the federal No Surprises Act, but some exceptions apply.

To Avoid Surprise Billing:

- Verify all providers are in-network

- Get written confirmation of covered services

- Understand your rights under the Surprises Act

Payment Plans and Medical Credit Cards

Hospitals and medical providers often offer payment plans that let you spread the cost over time. Medical credit cards may seem like a solution, but be cautious—high interest rates can add to your debt.

Payment Options to Consider:

- Monthly installment plans without interest

- Low-interest loans or hardship programs

- Medical credit cards (only if terms are favorable)

Legal Protections and Reporting

Consumers have rights under the Fair Credit Reporting Act (FCRA). Incorrect or outdated medical debt must be removed from your credit report. You can dispute these entries with consumer reporting agencies.

Know Your Rights:

- Prohibit lenders from reporting certain debts

- Dispute inaccurate reports

- Seek legal help when necessary

Insurance Companies and the Role They Play

After a crash, your or the other driver’s insurance company plays a major role in covering medical expenses. However, they may not pay the total amount or may delay payments.

What to Expect:

- Delays in insurance payment

- Denied or reduced claims

- Need for follow-up and documentation

How to Lower or Negotiate Hospital Bills

Hospitals may charge different amounts for the same service depending on whether you are insured, uninsured, or part of a specific program. If you’re facing high bills, negotiation is an option.

Steps to Take:

- Request an itemized bill

- Ask about financial assistance

- Negotiate the cost based on average rates

- Compare costs from other providers

What If You’re Uninsured?

Uninsured patients may face the highest medical bills. However, programs exist to help uninsured or underinsured individuals with help paying for care.

Potential Solutions:

- Apply for Medicaid or ACA marketplace plans

- Request charity care or reduced fees

- Utilize nonprofit hospitals’ assistance programs

FAQs About Medical Bills After an Accident

Can hospitals charge me more if I don’t have insurance?

Yes, uninsured patients often pay the full amount, but laws and programs can help lower costs.

Will medical debt affect my credit?

Yes, if unpaid bills are reported to credit bureaus, they can lower credit scores.

What is an explanation of benefits (EOB)?

An EOB is a document from your insurer that explains what medical services were covered and what portion you owe.

Can I refuse to pay surprise medical bills?

In many cases, the No Surprises Act protects you. You can dispute unfair charges and seek assistance.

How can I get more help?

Speak with hospital billing departments, look into local programs, or consult a legal expert. Organizations like the National Consumer Law Center offer free guidance.

Get the Legal Help You Need to Take Control of Your Medical Bills

Being in a crash is traumatic enough without the crushing burden of medical bills. Whether you’re dealing with insurance disputes, mounting medical debt, or surprise hospital bills, you don’t have to face it alone. At CO Car Accident Lawyers, we help accident victims like you secure compensation for medical expenses, protect credit scores, and fight for every dollar you’re owed.

Our experienced team knows how to handle complex medical billing issues, negotiate with insurance companies, and hold negligent drivers accountable. If you’re uninsured, underinsured, or overwhelmed by bills you don’t understand, we’re here to help you take back control.

Don’t let medical bills ruin your financial future. Contact CO Car Accident Lawyers today 864-313-2487 for a free consultation and find out how we can help you reduce or eliminate your out-of-pocket costs and get the relief you deserve. Your recovery starts with a single step—reach out now and let us fight for you.